Purging Benefits Data

Every time an employee makes a benefits change, a new record is stored in the benefits table. Additionally, a new record is stored in the employee’s deduction master table for each deduction related to that benefit. If these records are allowed to accumulate unchecked, this can slow down payroll processing and even cause errors. The larger the benefits and deductions table become, the slower payroll batch jobs will run. These batch jobs, such as PR140, loop through each record in these benefits and deductions tables so that the correct deductions are applied. Some of these batch jobs have a limit of the number of records allowed, so if an employee has deductions that exceed that limit, the job will error out. Also, traversing through these records can greatly slow down processing.

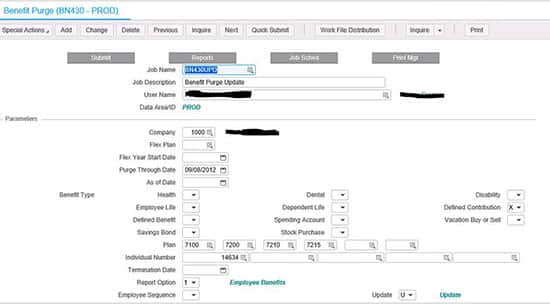

To help alleviate these issues, we recommend running the BN430 benefits purge program periodically. When you are processing payroll, if you see an error similar to “26 20591 PRDED-DED-TABLE must be increased; Cur size 0500”, chances are you have an employee with too many benefits changes, and need to run the BN430. But, before you receive this error, you should make the benefits purge part of a normal maintenance process. Ideally, payroll users would make this part of the payroll process each pay period, and choose a “Purge Through Date” corresponding to your company’s record retention period.